Investment Strategy by Larry Adam, Chief Investment Officer, Private Client Group

Weekly Headings

July 12, 2019

Key Takeaways

- Macro trade and monetary policy optimism have lifted the U.S. equity market to record levels

- Second quarter earnings growth likely to be lifted from negative to positive territory

- With elevated equity valuations, positive forward guidance needed to maintain momentum

For the next several weeks, we will go from talking about the proverbial forest (macro headlines) to focusing on the trees (corporate earnings). The forest has grown to record levels (S&P 500 crossing the 3,000 level for the first time and notching its ninth record close of the year) on the back of policy “fertilization.” The thaw in trade tensions between the U.S. and China following the Trump/Xi G-20 meeting and a growing synchronized global central bank dovish tone (highlighted by Fed Chair Powell in his testimony this week) have increased optimism that the U.S. (and global) economic expansion will gain momentum. In fact, the S&P 500 P/E (LTM) has soared to ~18x to reflect a market priced close to perfection. However, outside of the strong June U.S. employment data, other U.S. economic data (manufacturing, housing) and global data (Europe PMIs in contraction) suggest “clouds” of weakness forming. As earnings are the fundamental driver of the equity market, 2Q earnings season will give us a picture of how healthy the “trees” are as many of the big banks kick-off the reporting season next week. Below are some of the key dynamics to monitor throughout the upcoming earnings season:

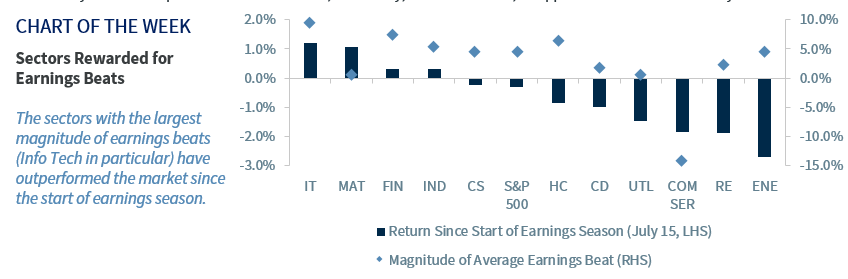

- Avoiding Negative Earnings Growth | After being revised down 2.4% since the start of the second quarter and the largest number of negative earnings pre-announcements since 2016, consensus earnings forecasts currently reflect an earnings decline of 1.4% on a year-over-year (YoY) basis. Based on history, our expectation is that companies will beat their lowered earnings forecasts (which they have done for five consecutive quarters) by ~3% to 5% and lift earnings growth back into positive territory. Early indications suggest we will be correct because of the 24 S&P 500 companies that have reported, 84% of companies have beaten earnings estimates by an average of 8.8%. The bigger question is whether the second quarter in a row of sub-2% earnings growth (with the prospects of a third consecutive quarter next quarter—3Q earnings growth estimate is currently +0.1%) can serve as a catalyst to take equity prices higher from current levels. Similar to earnings, revenue growth is also expected to be fairly muted as top-line sales growth is expected to rise 5.3%, which would be the lowest pace since 3Q16 if this forecast holds.

- Forward Guidance Will be Key | Given the heightened uncertainty surrounding the trade conflict, a stronger dollar and slowing global economic momentum, the magnitude of the negative impact on cyclical U.S. companies (Tech, Industrials, Materials) remains unclear. As a result, forward guidance and its impact on future earnings forecasts will be key. While second quarter earnings growth will likely avoid being negative, the current +0.1% YoY forecast for 3Q19 will likely be revised lower into negative territory. In addition, the lofty ~7% consensus earnings forecast for 4Q19 and 11% for full-year 2020 lack clear visibility, and if the trend of downward revisions continues, it could hamper the near-term upside potential of the market.

- Trade Impact on Tech | While Info Tech has been the best performing sector year-to-date (YTD) (up 31% through July 11), Info Tech has been one of the most impacted sectors as a result of trade given its exposure to China and the sanctions imposed on Huawei. As a result, commentary from management will be crucial, particularly as the sector is expected to post its worst quarterly earnings decline (-9.3% YoY) since 2Q09 and continue that trend into the third quarter (current consensus forecast -6.8% YoY). However, it is important to note that Info Tech historically beats earnings estimates, on average, by a healthy ~5%.

- Net Margins and Financials | Despite tailwinds from increased M&A and IPO activity and positive stress test results from the Fed, Financials continue to underperform the broad S&P 500 YTD as a result of falling global sovereign interest rates and the narrowing yield curve. These negative factors’ impacts on net margins will be a key determinant for the sector going forward.

- Health of the Consumer | Consumer Discretionary earnings are expected to decline 0.3% YoY, which would be the first quarterly earnings decline for the sector since 3Q17. Despite the slowdown in earnings, the key focus will be managements’ views on the health of the consumer, and if the tightening labor market is translating into an increase in consumer spending.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.